Shop

Showing 1–50 of 3685 results

-

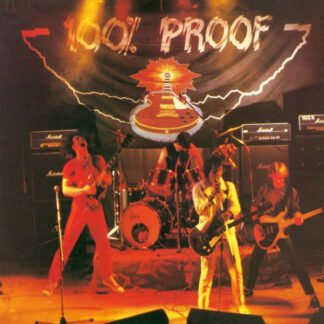

100% Proof (2) – 100% Proof (LP, Album)

£12.95 Add to cart -

10cc – 10cc (LP, Album)

£4.95 Add to cart -

10cc – Greatest Hits 1972-1978 (LP, Comp, CBS)

£9.95 Add to cart -

10cc – Ten Out Of 10 (LP, Album)

£4.95 Add to cart -

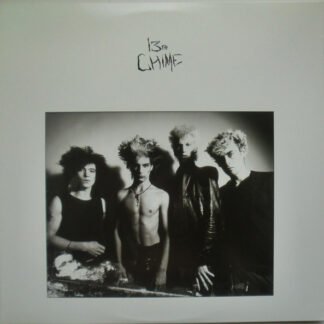

13th Chime – The Lost Album (LP, Comp)

£14.95 Add to cart -

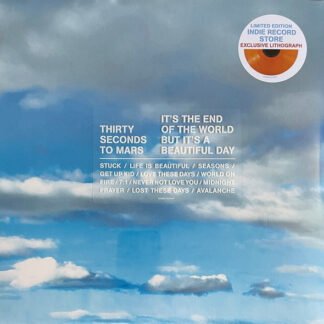

30 Seconds To Mars – It’s The End Of The World But It’s A Beautiful Day (LP, Album, Ltd, Ora)

£21.95 Add to cart -

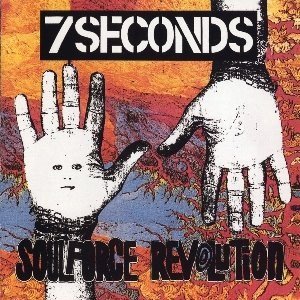

7 Seconds – Soulforce Revolution (LP, Album)

£39.95 Add to cart -

999 – The Biggest Prize In Sport (LP, Album)

£11.95 Add to cart -

A Certain Ratio – Brazilia (12″)

£8.95 Add to cart -

A Day To Remember – You’re Welcome (LP, Ltd, Red)

£9.95 Add to cart -

A Flock Of Seagulls – Who’s That Girl (She’s Got It) (7″, Single, Whi + 7″, Shape, S/Sided, Mixed, Pic)

£9.95 Add to cart -

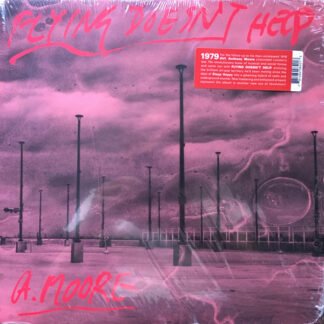

A. More* – Flying Doesn’t Help (LP, Album, RE)

£11.95 Add to cart -

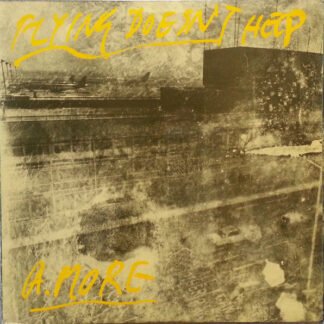

A. More* – Flying Doesn’t Help (LP, Album, Yel)

£8.95 Add to cart -

A.A.Williams – Arco (12″, EP, Pur)

£24.95 Add to cart -

AA Sessions – The AA Sessions Vol. 1 (Fire Assembly Point) (LP, Red)

£8.95 Add to cart -

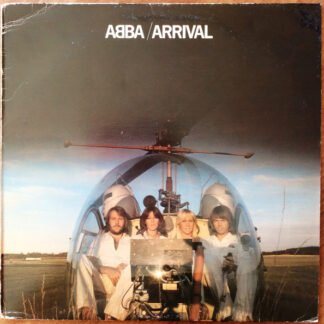

ABBA – Arrival (LP, Album)

£4.95 Add to cart -

ABBA – Chiquitita (7″, Single, Sol)

£0.95 Add to cart -

ABBA – Does Your Mother Know (7″, Single, Pus)

£1.95 Add to cart -

ABBA – Greatest Hits (LP, Comp, RE, Ora)

£3.95 Add to cart -

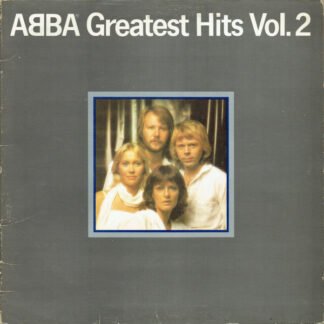

ABBA – Greatest Hits Vol. 2 (LP, Album, Comp, Net)

£4.95 Add to cart -

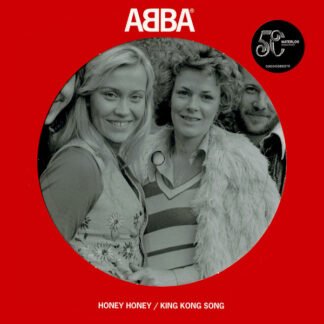

ABBA – Honey Honey (7″, Single, Pic, RE)

£15.95 Add to cart -

ABBA – Summer Night City (7″, Single)

£1.95 Add to cart -

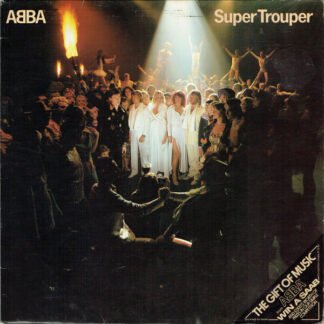

ABBA – Super Trouper (LP, Album)

£3.95 Add to cart -

ABBA – The Album (LP, Album, Gat)

£6.95 Add to cart -

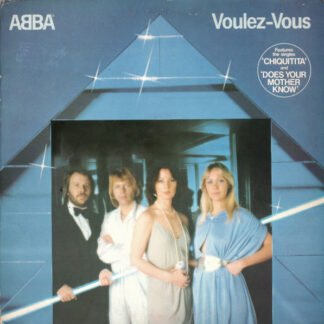

ABBA – Voulez-Vous (LP, Album)

£5.95 Add to cart -

ABBA – Voyage (LP, Album, Gat)

£12.95 Add to cart -

ABBA – Waterloo (Swedish Version) / Honey Honey (Swedish Version) (7″, Single, Pic, RE)

£15.95 Add to cart -

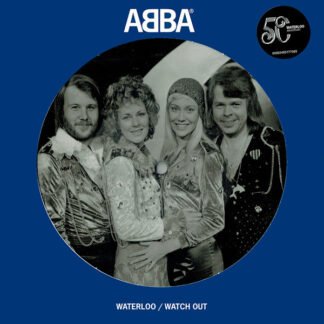

ABBA – Waterloo / Watch Out (7″, Single, Pic, RE)

£15.95 Add to cart -

ABBA, (Björn, Benny, Agnetha & Frida)* – Waterloo (2xLP, Album, RE, RM, Hal)

£39.95 Add to cart -

ABBA, (Björn, Benny, Agnetha & Frida)* – Waterloo (2xLP, Album, RE, RM, Hal)

£39.95 Add to cart -

Abbey Lincoln ( Aminata Moseka ) Featuring Archie Shepp – Golden Lady (CD, Album, RE)

£6.35 Add to cart -

AC/DC – Back In Black (LP, Album, RE, RM)

£22.95 Add to cart -

AC/DC – Let There Be Rock (7″, Single, RE)

£19.95 Add to cart -

AC/DC – Let’s Get It Up / Back In Black (Recorded Live Dec 1981) (7″, Single)

£5.95 Add to cart -

Across The Water II – Scillonian Solace (LP, Album, Ltd)

£11.95 Add to cart -

Adam & The Ants* – Antmusic (7″, Single, Pap)

£1.75 Add to cart -

Adam And The Ants – Stand & Deliver! (7″, Single, Inj)

£2.95 Add to cart -

Adam Ant – Friend Or Foe (LP, Album)

£8.95 Add to cart -

Adam Faith – I Survive (LP)

£4.15 Add to cart -

Adam Faith – What Do You Want? (7″, EP, Promo)

£0.95 Add to cart -

Adamski – The Space Jungle (Earthquake Remix) (12″)

£3.95 Add to cart -

Aerosmith – Cryin’ (12″, Single, Ltd, Whi)

£8.95 Add to cart -

Affinity (4) – Affinity (LP, Album)

£179.95 Add to cart -

Aimee Mann – Magnolia (Music From The Motion Picture) (CD, Album)

£2.95 Add to cart -

Al Cohn & Zoot Sims – Motoring Along (LP, Album)

£3.95 Add to cart -

Al Di Meola – Casino (LP, Album, RE, RM, 180)

£31.35 Add to cart -

Al Di Meola – Casino (LP, Album, RE)

£5.95 Add to cart -

Al Di Meola – Elegant Gypsy (LP, Album)

£11.95 Add to cart -

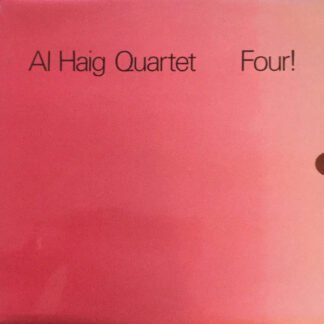

Al Haig Quartet – Four! (LP, Mono)

£9.95 Add to cart

Showing 1–50 of 3685 results